Can domestic selumetinib be successfully launched in 2026? Forecast of the market impact of cobimetinib

At present, domestically produced selumetinib (selumetinib) has a high probability of being successfully launched in China, but it still needs time to advance. 2025year2month, AstraZeneca/The marketing application for selumetinib hydrogen sulfate jointly submitted by Merck has been accepted by the Center for Drug Evaluation of the State Food and Drug Administration (CDE), which means that the registration and approval of the drug in China is in substantial progress. The application is based on the drug’s previous approval in China for the indication of 3 and above with symptomatic, inoperable NF1 type plexiform neurofibroma (PN). The acceptance signal indicates that the approval process has been initiated, laying the foundation for future expansion into adults or other indications.

Approval entering the acceptance stage is a critical first step for listing, but subsequent steps still need to be completed such as technical review, clinical data evaluation, and expert review. Therefore, whether all approvals can be completed and finally launched by the end of 2026 still depends on the progress of the approval and the completeness of the submitted data. If the application materials meet the requirements and the review proceeds smoothly, it is expected to be approved within 1–2 years. In view of the fact that this drug has mature approval experience around the world (such as the United States and the European Union for use in children with NF1 , etc.), this is a favorable reference for domestic review.

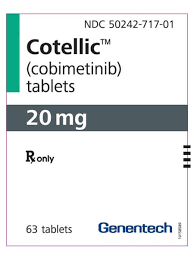

If domestically produced and imported selumetinib are fully approved for marketing in China, its impact on the cobimetinib market may be relatively limited. The reason is that although they are both MEK inhibitors, they have different indications: the main indication of selumetinib is NF1 type plexiform neurofibroma, while cobimetinib (cobimetinib) is mainly used to treat BRAF V600 mutation-positive melanoma in combination with BRAF inhibitors. The two have similar targets but do not completely overlap in clinical application scenarios, so they will not directly form significant competition.

However, from a more macro market perspective, the launch of selumetinib will strengthen the layout of the MEK pathway inhibitor product line in China, and will promote the overall MEK inhibitor drug market. As the approval of domestic innovative drugs accelerates, a competitive landscape for similar targeted drugs will gradually take shape, which may indirectly promote adjustments in indication expansion, combination drug strategies and price strategies for similar drugs (including cobimetinib). Overall, selumetinib is more likely to be successfully launched in 2026 . The direct market impact on cobimetinib is expected to be limited, but it will promote the clinical understanding and application development of drugs targeting the same pathway in China.

Keyword tags:

Selumitinib, domestically produced, approval progress, 2026 forecast, market impact, cobimetinib, MEKinhibitors

Reference materials:https://finance.sina.com.cn/stock/med

[ 免责声明 ] 本页面内容来自公开渠道(如FDA官网、Drugs官网、原研药厂官网等),仅供持有医疗专业资质的人员用于医学药学研究参考,不构成任何治疗建议或药品推荐。所涉药品可能未在中国大陆获批上市,不适用于中国境内销售和使用。如需治疗,请咨询正规医疗机构。本站不提供药品销售或代购服务。

.jpeg)